Current location:International Issue news portal > entertainment

Cedric Mullins hits 2

International Issue news portal2024-04-18 12:21:29【entertainment】6People have gathered around

IntroductionBALTIMORE (AP) — Cedric Mullins hit a two-run homer in the bottom of the ninth inning to give the Ba

BALTIMORE (AP) — Cedric Mullins hit a two-run homer in the bottom of the ninth inning to give the Baltimore Orioles a 4-2 victory over Minnesota on Wednesday and a three-game sweep of the Twins.

It was the first career walk-off homer for Mullins.

“I wasn’t trying to do too much right there,” Mullins said. “Mounty got us going with a single. I was trying to follow it up with another single. I was able to get a pitch that I can handle, and I put it over.”

Gunnar Henderson and Anthony Santander also went deep for the Orioles, their fifth straight game with at least three home runs. Baltimore had a streak that long only twice before in franchise history, in 1996 and 1987.

With one on and one out, Mullins hit a drive to right field off Griffin Jax (1-2) for his fifth homer of the year. Craig Kimbrel (3-0) worked a 1-2-3 top of the ninth.

Address of this article:http://www.olivelawfirm.net/2019/09/27/how-much-money-can-i-get-from-my-car-accident-settlement-personal-injury-attorney-answers/

Very good!(98858)

Related articles

- Nathan MacKinnon races to career season, looks to power Colorado Avalanche on another title run

- Xi pays visit to grassroots officials and residents in Tianjin ahead of Spring Festival

- Xinhua Special: Warm Moments of Xi's Visits Ahead of Spring Festival

- Roundup: Ethiopian gov't, rebels agree to ceasefire

- Duke's Jeremy Roach announces plans to enter NBA draft and transfer portal

- One year of war in Sudan, thousands killed, millions displaced amid imminent famine

- Bolivia urges UN to facilitate peace in Middle East

- 15 killed in road accident in central Ethiopia

- South Carolina Republicans reject 2018 Democratic governor nominee's bid to be judge

- Market for African Performing Arts of Abidjan held in Cote d'Ivoire

Popular articles

Recommended

North Carolina University system considers policy change that could cut diversity staff

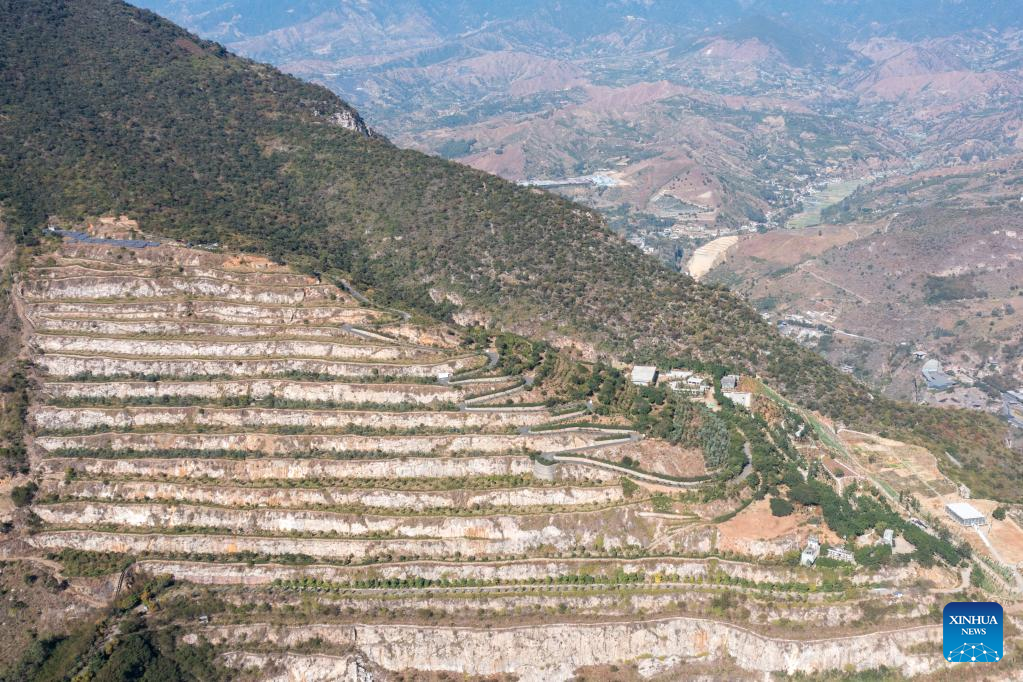

Bare mountains turn green again through ecological restoration in SW China's Sichuan

Domestic passenger flights resume operation in Sanya

China urges international community to continue supporting Palestinian refugee relief

The habits that add decades to your life

Feature: Return of Chinese tourists contributes to Egypt's tourism rebound

China urges U.S. to stop harassing Chinese students

Tanzania to host field training for over 600 senior police officers from 14 African countries

Links

- US House passes controversial surveillance bill on 4th attempt

- Sandringham House is filled with the spirit of the King's gentle

- What is happening with the NZ housing market this week?

- A quiet birthday for Meghan's former best

- Perfect for a 'slimmed

- When the touchy

- From gadget king to royal Luddite

- TikTok crackdown bill unanimously approved by US House panel

- US House passes controversial surveillance bill on 4th attempt

- Sandringham House is filled with the spirit of the King's gentle